2024 and beyond

predictions, picks and rivalries

Leading into 2023 I wish I had money to invest, because it was clearly such a great buying opportunity after the late 2022 market crash led by cryptocurrencies and technology stocks like Tesla, Meta and Amazon. The greatest of those buying opportunities was the cryptocurrency Solana, which I wrote about in my first post. It’s not surprising these assets recovered over 2023 and achieved enormous gains.

Looking to 2024, I don’t see any buying opportunities that are as clear and certain. Stocks with signals for outsized performance have other signals for abnormal risks. What seems clear is the need to broaden, diversify and be more cautious when buying. January is a good time to trim or sell big winners from last year and reap profits. Unless a big dip comes in January, I’d wait until February to start buying most tech stocks, growth stocks and crypto. I’d start right away buying stocks like Exxon, Seadrill, Citigroup, Bristol Myers, Peloton, Verizon, and most ETFs in my list.

The best tentative plan for 2024 seems to be dollar-cost averaging into the market, spreading out investments month to month, buying more during any big dips. I see this year as a time to buy at the right moments, not expecting to see any major gains until 2025 and letting yourself be pleasantly surprised if there are big gains this year. I don’t expect the market to be as good as 2023 and 2021, or as bad as 2022. But anything can happen in 2024.

I’ve been using Yahoo Finance and Nasdaq.com to get info about stocks, and Coinbase for info about crypto. What tools give you the most useful information?

Top 24 stock picks for 2024:

Amazon - (AMZN) - megacap Mag 7 (see long-term forecast in section below)

Citigroup (C) - large cap financial, down 90% from high, could be on its way up

SeaDrill (SDRL) - midcap offshore oil drilling, good PE, growth potential

Rigetti Computing (RGTI) - microcap quantum computing w potential for growth

Innodata Inc. (INOD) - microcap data company supporting A.I.

SOFI - (see *note at bottom of this list)

Verizon (VZ) - It’s down 50% from its high and has a very good PE (price/earnings)

Peloton (PTON) - down 96%, on its way up

Paypal (PYPL) - down 82% from high and decent PE, new CEO has good record.

Samsung (SMSN) - good PE, best cell phone maker, leading chip maker outside Taiwan, is building $17 billion plant in Texas & may qualify for CHIPS money

Texas Instruments (TXN) - Texas-based, may receive $2 billion from CHIPS Act

Skywater Tech (SKYT) - small cap American chip maker with growth potential

STMicroelectronics (STM) - Swiss chipmaker with geographical diversification

Intel (INTC) - could get $10 billion from CHIPS Act

TEGNA (TGNA) - media ads / election year

Toll Brothers (TOL) - residential construction, low PE, good earnings

Bristol Myers (BMY) - large cap health care, good PE

Exxon (XOM) - megacap energy, good PE, good dividends.

Tesla (TSLA) - (see long-term section below)

Walmart (WMT) - (see below)

Google/Alphabet (GOOG) - (see below)

Polaris (PII) - (see below)

Dino Polska (DNOPY) - (see below)

Coinbase (COIN) - (see below)

*I recently shopped for the highest interest yielding savings account and found it at SoFi, a user-friendly, one-stop-shop platform. It comes with a free online checking account. It’s all online, no brick and mortar.

Right now they are offering 4.6% for savings, as long as the account receives a monthly direct pay deposit of any amount. That yield is higher than any treasury right now. Without direct pay deposit, they offer 1.2% for savings and .5% for checking, which is still much better than the .01% at Chase or Bank of America.

SoFi offers points when your credit score goes up and for using various services. And they offer bonuses, such as $25 for opening checking/savings with this referral. They offer $50 for putting $10 into an investing account with this referral. And they offer credit cards and other financial services.

ETFs for diversification:

SYLD (energy, materials, industrials) - value, quality, with low PE & high yields

FYLD (foreign) - second of three Cambria funds

EYLD (emerging)

ITA - U.S. aerospace and defense

CIBR - cybersecurity

GDX - gold miners

SLV - silver

INDA - India

XBI - biotech

XLP - consumer staples

SLYG - small caps growth

VYMI - foreign large cap value

VXX - volatility

VHT - health care

Additional diversification:

WTBN - fixed income bond fund by Wisdom Tree / Jim Bianco

Buy 10-year treasury if it rises to 5.5%

physical gold and silver coins, box of nickels, emergency supply of $, food & water

farmland and real estate

Long term moves and rivalry winners - what I see over the next 5 - 15 years:

Tesla, Amazon & Google vs. Apple & Microsoft - I believe the two pioneers of the personal computer revolution reached the pinnacle of their stock market dominance in 2023 after years of trading thrones as the most valuable company in the world. I also believe the closed/trapped systems their products depended on will go down with them in favor of more open systems. I believe there will be three new kings hot on their heels, battling for the throne. I can see Microsoft taking it back from Apple for a time, until Google catches up and takes it for a short time, followed by Amazon. Then Tesla takes and holds the crown as most valuable company in the world.

Coinbase vs. Chase - COIN grows 10x and becomes the J.P. Morgan Chase of cryptocurrency, as crypto and tradfi battle for the future of finance.

Google vs. Microsoft - Microsoft’s market cap is $2.76 trillion, has a PE ratio of 36 and is expected to grow earnings by 59% over three years. Google’s market cap is $1.75 trillion, has a PE ratio of 27, and is expected to grow earnings 59% over three years. If we reduce Microsoft PE to 20 and grow it by 59%, then in three years its value would be $2.44 trillion, less than it is today. If we reduce Google PE to 20 and grow it by 59%, its value would be $2.06 trillion, more than it is today. Microsoft is valued 58% more than Google. I believe Google will close that gap soon and eventually surpass Microsoft in market cap. (This is the prediction of an amateur who is probably missing many factors and possibly misreading others.)

-Microsoft’s investment in self-driving car company Cruise is doing awful. Google’s Waymo seems to be doing better.

-From my experience as an everyday A.I. user, Google's Bard provides better answers and information than Microsoft’s GPT-powered Bing Chat.

-Looking at free technology classes available online, Google always has the highest user ratings, higher than others like IBM.

-Google seems to have the edge in most everything it does and seems to have a bright, budding future in the cell phone hardware design business, and is making a big move on quantum computing.

-I just heard Jim Cramer talking about foolishly ignoring the negative impact litigation could have on his past investment in J&J. The New York Times’ recent lawsuit against Open AI & Microsoft could be the first of many. It does not seem investors have noticed this litigation risk yet, but that time may come.

Samsung vs. Apple - Samsung has been making better phones than Apple for a while now. I’ve always been annoyed by Apple products but that really set in when I shopped for a phone last year. Apple has dropped the ball. I see that trend continuing. Even if Apple continues making money from PC sales and services, I don’t think it’s enough to maintain the enormous distance between its stock and Samsung’s. Apple has a PE ratio 3 times Samsung. Apple’s market cap is 8 times more than Samsung. If their PE ratios were to match each other, that would be very good for Samsung’s stock and very bad for Apple’s. I don’t know the risk potential Chinese military aggression in East Asia poses to Samsung or whether a Chinese invasion of Taiwan would help or hurt their stock.

Meta vs. Apple - It seems what Meta is doing with the metaverse will make them a lot more money, and be much better for their stock, than what Apple is doing.

Polaris and Can-am vs. GM, Ford & Stellantis - I see a future with a lot more open-air small vehicles on the streets, including Polaris’ Slingshots and Can-am’s Spyders - and sadly, less cars made by American car companies. I look forward to buying Polaris stock when I can. Too bad Can-am is privately held.

DP vs. 7-11 - I like the story of Polish company Dino Polska, a retail alternative to the large superstore model already dominated by Walmart. It’s a company experiencing fast growth and still run by its founder and primary owner. I see a future when populations get more spread out over land and there will be a need for a retail chain that builds a larger number of smaller stores, spread out to reach anyone who wants access to one. Having a small grocery store with a deli and other essential goods, attached to a gas and electric charging station, sounds appealing. Maybe they will lease parts of their properties to other businesses, to help make it a one-stop-shop, like the way Starbucks and Chipotle attach themselves to each other. They'll probably call it the DP store if they expand to the west. Imagine walking into the store after filling up your tank and getting a fresh ham sandwich, instead of the garbage food you get at 7-11.

Walmart vs. Target, Instacart & Doordash - Walmart is making the most of their retail dominance by creating their own delivery app and I think their delivery technology could surpass the efficiency of others and be adopted by other retailers. I also think Walmart will have a more efficient delivery system than Target will. I wouldn’t be surprised if the day comes when Walmart is fully automated for pickup/delivery, with a walk-in section for select items. If you want to walk through a store, you go to Target. It’s always more pleasant walking through a Target than it is a Walmart anyway and Walmart would experience less theft. Walmart’s inroads with India is a plus. I don’t know if there is a way for Amazon to encroach into Walmart’s niche, as far as risks go.

India vs. China - I’m convinced by the narrative that we will see economic growth in India in the decades ahead like we saw in China in the decades behind.

BRICS vs the west - this alternative alliance / potential monetary system could give the dollar a run for our money. We should not take our privileged economic position for granted.

CRYPTO:

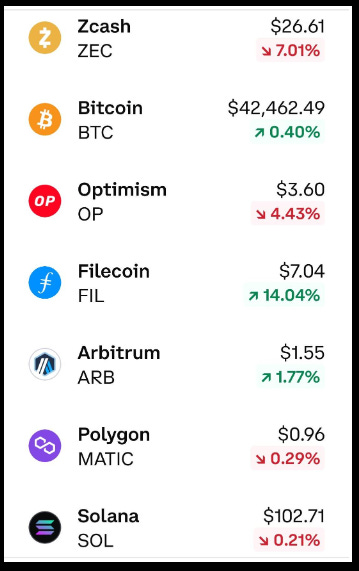

Like other assets, I don’t see a single crypto that stands out like Solana did a year ago and I would spread out any crypto investment among multiple coins. My top pick for 2024 is ZCash, the privacy coin. As with Solana when I called a buy on it over a year ago, it is a contrarian call nobody else is making. It is an asset surrounded by negative publicity. Unlike Solana, it is not so clear and is far less certain. If ZCash does achieve gains in 2024, it’s possible we won’t see it until the very end of the year.

ZCash is one of the few coins that ended 2023 lower than it began, dropping to half its starting price. Recently it received bad press after an exchange I never heard of delisted all privacy coins. ZCash is known as the preeminent privacy coin. As we see more centralized bank digital currency activity, I could see the value of a privacy coin like ZCash rallying. The risk is its price could be suppressed by legal uncertainties over currencies with that level of privacy.

Bitcoin is my second crypto pick because of the ETFs expected to be approved for it any day now and the halving in April. If you want crypto exposure without using a centralized crypto exchange or without delving into the harrowing world of decentralized crypto exchanges and self-custody, an ETF could be the way to go. I would not invest any money in crypto I can’t afford to lose, especially not right now. The only coins I would buy right now are ZCash and Bitcoin, both of whom are likely to have dips throughout the year, but likely to end the year higher than they started.

Twelve crypto picks for 2024:

ZCash (ZEC)

Bitcoin (BTC),

Optimism (OP)

Filecoin (FIL)

Arbitrum (ARB)

Polygon (MATIC)

Solana (SOL)

Chainlink (LINK)

Avalanche (AVAX)

Celo (CGLD)

Decentralized Social (DESO)

Litecoin (LTC)

If you’d like to donate to support this newsletter, you can click on either of these links to donate through PAYPAL or VENMO.

TECH TIPS:

Stable Diffusion and Microsoft Bing / OpenAI / DALL-E generate images far more creative and graphically intricate than Google’s image generator, but Google seems far more capable of understanding and following instructions, even though it is not as available for use. The first two don’t seem able to keep a four-digit number together. I told all three to make an image with the number “2024” for the year 2024. The first two have all sorts of variations on that number floating around. Bing/DALL-E does not have the number intact anywhere. Even after followup prompts asking them to keep the number 2024 together and display it in large characters, they did not. The cover image at the top of this article is what Google generated. I only had to ask once. Midjourney is not now providing free image generation so I can’t compare it.

POLITICAL PREDICTIONS:

We left an era of three successive two-term presidents and it seems we are now in an era of three successive one-term presidents. With the backing of Biden, Harris and the Obamas, I believe Democrats will make a last minute nomination of California Governor Gavin Newsom and he will go on to defeat Donald Trump and become the next president. Democrats also take the House, but Republicans take the Senate. Whichever party’s frontrunner steps aside for a new candidate is likely to win, considering majority unfavorable opinion polls for both Trump & Biden. I was wrong in thinking Democrats would not nominate Biden in 2020 and could be wrong again.

There will be wars and economic volatility. If war breaks out over Taiwan, the global economy will crash. If peace is made in Asia, Europe and the Middle East, there will be a period of roaring economic prosperity. There will be a changing international order with the emergence of alliances like BRICS.

In the above 2024 election outcome scenario, there would be no new Supreme Court justices until either Democrats win the Senate or a Republican like Ron DeSantis gets elected president in 2028, which I think would happen. Just as the landscape of the international order is reshaped, I believe the landscape of our national order will be reshaped as well.

As technology advances, an even greater divide will develop in the world between authoritarianism and libertarianism. Freedom will only be preserved in nations that deliberately prevent new technologies from being used to eradicate it. As free countries become more decentralized, they will need to keep strong centralized military forces to deter aggression from authoritarian powers elsewhere in the world. Just as Tesla becomes the leading company in many sectors, I could see it becoming the leading defense contractor, providing electric-powered, manless military assets.

Typically, there’s a market gain after a presidential election. It could happen this year, but there are variables, like the risk to the markets from potential Chinese aggression in east Asia. If China will invade Taiwan and any other territories, it seems they would want to do it in a way that minimizes U.S. opposition. That would be after the U.S. presidential election but before Biden leaves office. But who knows, maybe Biden will stand strong enough to deter China. After inviting disaster in Afghanistan and Ukraine, he surprised by acting to deter a broader war from breaking out in Israel.

If it has not already happened, I would be watching November - December 2024 for a potential Chinese attack, and as a time period when anything can happen in the economy - rally or crash. It seems the only reason China hasn’t already taken Taiwan is the U.S. Navy. But they may also be worried Taiwan will destroy their own semiconductor industry before China can seize control of it. China would be harming themselves as much as everyone else in the world. Hopefully a diplomatic solution can prevent war.

China has said Taiwan’s January presidential election is a choice between war and peace, and has called their front-runner a “destroyer of peace.” There is an eerie parallel between the China/Taiwan situation and that of Russia and Ukraine. I wonder if we will have advance warning of a Chinese attack like we did when Russia gathered troops at the Ukrainian border before invading.